november child tax credit amount

IR-2021-222 November 12 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their. IR-2021-211 October 29 2021 On Monday November 1 the Internal Revenue Service will launch a new feature allowing any family receiving monthly Child Tax Credit.

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

Liability by the amount of the child tax credit.

. Currently eligible families that claim the child tax credit can subtract up to 2000 per qualifying child from their federal income tax liability. THE child tax credit program continues with another payment set to be issued next weekAs part of President Joe Bidens American Rescue Plan qualif. According to the IRS you can use the Child Tax Credit Update Portal to see your processed monthly payment history.

The maximum amount of the child tax credit per qualifying child that can be refunded even if the taxpayer owes no tax. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if. The IRS will soon allow claimants to adjust their.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit.

Liability by the amount of the child tax credit. Liability by the amount of the child tax credit. Itll be a good way to watch for pending payments that havent gone.

The full expanded child tax credit amount is 3000 for each qualifying child between ages 6 and 17 at the end of the 2021 tax year and 3600 for each qualifying child 5. The full expanded child tax credit amount is 3000 for each qualifying child between ages 6 and 17 at the end of the 2021 tax year and 3600 for each qualifying child 5. Currently eligible families that claim the child tax credit can subtract up to 2000 per qualifying child from their federal income tax.

If we had not processed your 2020 tax return when we determined the amount of your advance Child Tax Credit payment for any month starting July 2021 we estimated the. A childs age determines the amount. For 2021 eligible parents or guardians.

November 12 2021 1126 AM CBS Chicago. Currently eligible families that claim the child tax credit can subtract up to 2000 per qualifying child from their federal income tax. CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming Monday.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. When you receive free money you may wonder if theres a catch. For some who received the November advance payment of the Child Tax Credit there could beIf your income.

The credit expiration date is a onetime extension. Your check amount will be based on your 2021 Empire State child credit your New York State earned income credit or noncustodial parent earned income credit or both. Have been a US.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

Deadline For Child Tax Credit Is November 15 Whas11 Com

Child Tax Credit Fight Reflects Debate Over Work Incentives Thv11 Com

Gov Urges Eligible Ct Families To Apply For Child Tax Credit Before Nov 15 Deadline Nbc Connecticut

Child Tax Credit Payments May Be Smaller For Some Going Forward Wfaa Com

What Is The Child Tax Credit Tax Policy Center

Child Tax Credit Why November Payment May Be Less This Month 10tv Com

November Child Tax Credit Payment Dates 2021 When Does The Child Tax Credit Come In November News

Advance Child Tax Credit Financial Education

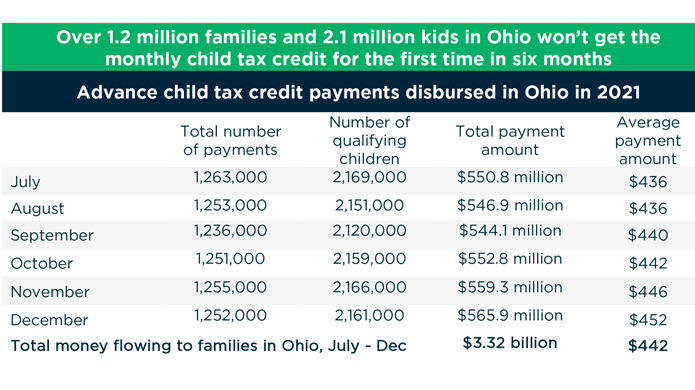

What S At Stake For Families As The Monthly Child Tax Credit Payment Ends Ohio Capital Journal

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Child Tax Credit 2021 This Is The Last Day To Opt Out Of Payments Fox Business

Today Is Your Last Chance To Claim Your November Child Tax Credit

When Is My November Child Tax Credit Irs Check Arriving 11alive Com

October Child Tax Credit Payment Kept 3 6 Million Children From Poverty Columbia University Center On Poverty And Social Policy

Future Child Tax Credit Payments Could Come With Work Requirements

Child Tax Credit Updates November Payments Starting Today Marca

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

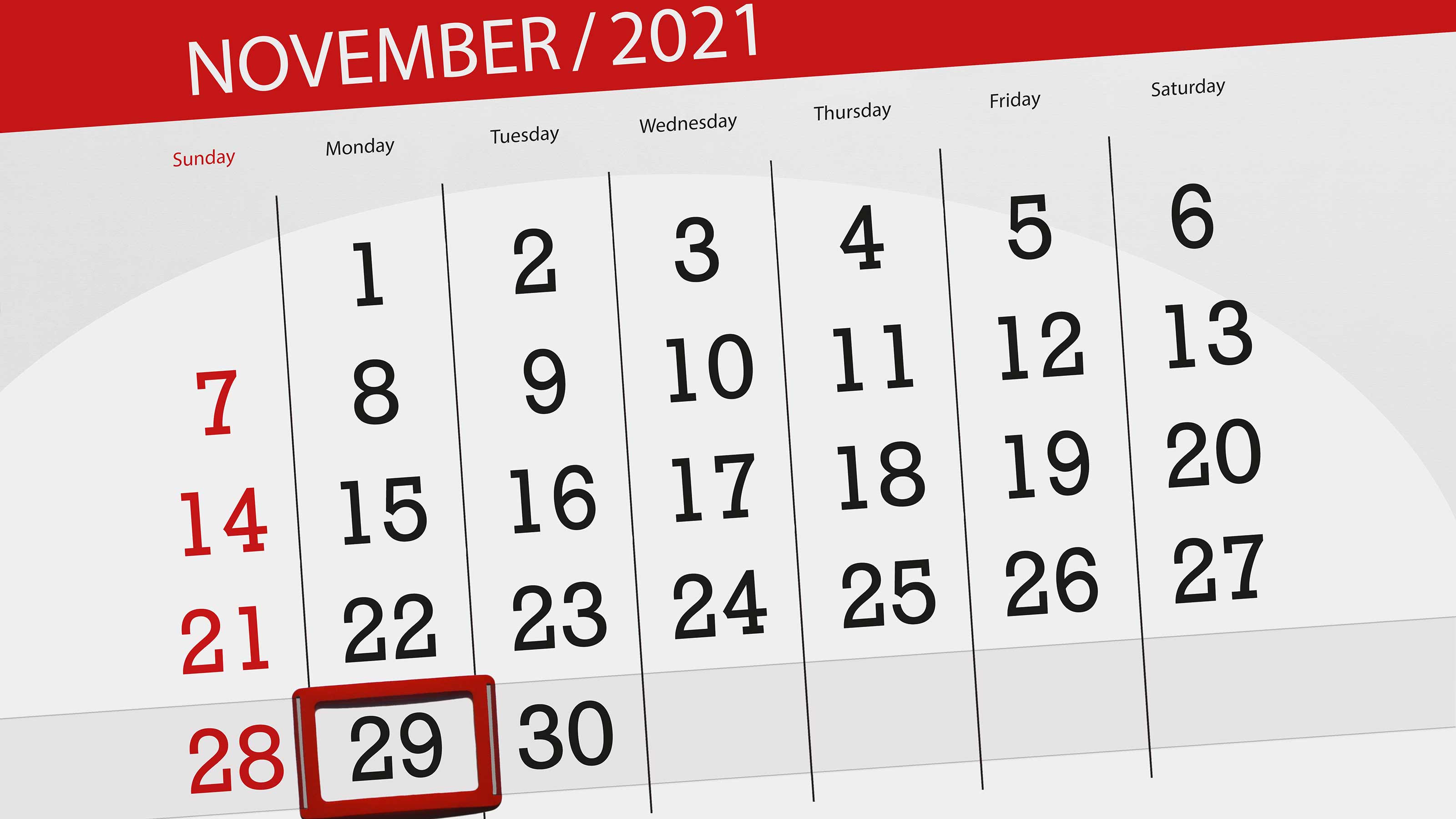

Final Child Tax Credit Payment Opt Out Deadline Is November 29 Kiplinger

Child Tax Credit Portal How To Update Your Income Details Before November 29 Marca